SOCIAL STOCK EXCHANGE: A NEW WAY OF INVESTING

ICAI Reg. no. : WRO0708784

CA Course Status : CA Intermediate

SOCIAL STOCK EXCHANGE: A NEW WAY OF INVESTING

In today’s time we often feel like helping the poor and underprivileged sections of our society but the biggest obstacle we face is the doubt regarding the legitimacy of the NGO’s (Non-Governmental Organisation). We face the issue of the doubts regarding the use of our donations by such NGO’s.

This is where SSE (Social Stock Exchange) comes into play. It helps both the investor as well as the NGO’s in regards to the donations for the poor and underprivileged sections of our society. An SSE will act as a bridge between the less-informed but willing donors and legitimate organizations doing real social work.

As market participants, we must know what SSEs are, what entities you can invest in, and what kind of returns you can expect.

What is Social Stock Exchange?

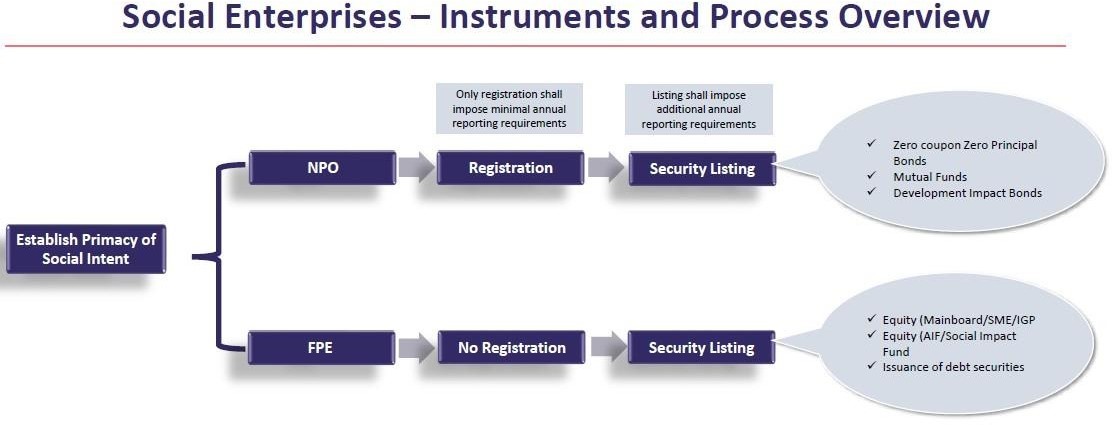

A social stock exchange is a platform where social enterprises/organizations can raise funds from the public. Organizations listed on the SSE can be For-profit Social Enterprises (FPEs) and Not-for-profit Organizations (NPOs).

SGBS Unnati Foundation (SUF) became the first entity to list on the social stock exchanges (SSE).

Eligibility Criteria:

Any FPR or NPO has to fulfil the below mentioned criteria to be eligible for raising funds through Social Stock Exchange:-

-

At least 67% of the immediately preceding 3-year average of revenues comes from providing eligible activities to members of the target population, OR

-

At least 67% of the immediately preceding 3-year average of expenditures has been incurred for providing eligible activities to members of the target population, OR

-

Members of the target population to whom the eligible activities have been provided constitute at least 67% of the immediately preceding 3-year average of the total customer base/beneficiaries.

We have now seen the various eligibility criteria’s which are to required to be fulfilled by various NPO and FPE to be able to raise their funds through Social Stock Exchange. Listing on Social Stock Exchange accrues the following benefits to such organisations:

-

Improved market access – SSE will facilitate a common and a structured meeting ground between Social Enterprises and investors/donors with inbuilt regulation for providing sanctity and accountability of finances

-

Synergy between investors and investee in social aims - In view of flexibility of investments and capital that would be available on an SSE, the canvas of choice would be much wider allowing investors and investees with similar missions and visions to connect seamlessly

-

Performance based philanthropy - Performance of the enterprises listed on an SSE would be monitored thus it will instil a culture of performance (Social return) driven philanthropy.

-

Minimal registration cost – SSE saves cost for both issuer and investor/donor by charging minimal fees for registration and listing.

- Additional avenue for Social Enterprises - Central and State governments till date have the biggest onus of achieving sustainable development goals. SSE will provide an alternate avenue for raising funds thereby encouraging new and existing social enterprises.

Funds which can be raised through Social Stock Exchange are as follows:

A Not-for-Profit organization after registering with Social Stock Exchange may raise funds on Social Stock Exchange through

-

Issuance of Zero Coupon Zero Principal Instruments [through private placement or public issuance]

-

Donations through Mutual Fund Schemes [as shall be specified]

- Any other means that SEBI may specify in future

Criteria for registration on Social Stock Exchange in respect of Not-for-profit organizations?

SEBI vide its circular has prescribed certain minimum requirements in order for a not-for-profit organization to register on Social Stock Exchange. In brief, these criteria include mandatory age of NPO as 3 years, valid certificate u/s 12A/12AA/12AB of the Income Tax Act, valid 80G registration, minimum INR 50 lakhs as annual spending and minimum INR 10 lakhs of fund in the past year etc.

It is not mandatory for Not-for-Profit Organizations which are registered with Social Stock Exchange under ICDR Regulations to seek listing, however it shall mandatorily seek registration with a Social Stock Exchange before it raises funds through a Social Stock Exchange.

A Not-for-Profit Organization may choose to register on a Social Stock Exchange and not raise funds through it. It can also continue to raise funds through any other means.

An organisation for profit as well as not for profit can raise funds through Social Stock Exchange. We have already seen ways in which an organisation not for profit can raise funds. Now, let us take a look at ways in which an organisation for profit can raise funds through Social Stock Exchange.

An organisation for profit may raise funds through Social Stock Exchange in the following ways:

-

Issue of Equity Shares (On Main Board, SME Platform or innovators growth platform of stock exchange as the case may be)

-

Issue of Equity Shares to an Alternative Investment Fund including Social Impact Fund

-

Issue of Debt Instruments

-

Any other means that SEBI may specify in future

Retail investors are permitted to invest only in securities offered by For-profit social enterprise under the Main Board. In all other cases, only institutional investors and noninstitutional investors can invest in securities issued by Social Enterprises. As per SEBI (Issue of capital and disclosure requirements) Regulations, 2018, a retail individual investor is one who applies or bids for specified securities for a value of not more than two lakhs rupees and non-institutional investor is defined as an investor other than a retail individual investor and qualified institutional buyer.